Intuit Data Ethics

Crafting trustworthy customer data experiences

Background

Companies are increasingly AI driven. To feed intelligent / predictive models, the way data is collected on users is increasingly scrutinized. The customer experience of these information exchange moments is critical to their overall satisfaction and trust in a service. Understanding customer mental models around the types of data they generate, where it flows, and how it is used is the first step…

Intuit is a global tech platform that helps customers grow their businesses and grow their financial wellbeing. As a Service Design Intern, I explored ways to ethically collect, analyze, and communicate sensitive financial data with our end customers.

Goal

Align the Intuit data platform with customer mental models around financial data collection / usage, to ensure an ethical, communicative, and trustworthy end customer experience.

Role

Service Design Intern

Stakeholders

End customer, Legal, PMs, Designers, Devs

Timeline

12 Weeks

Solution

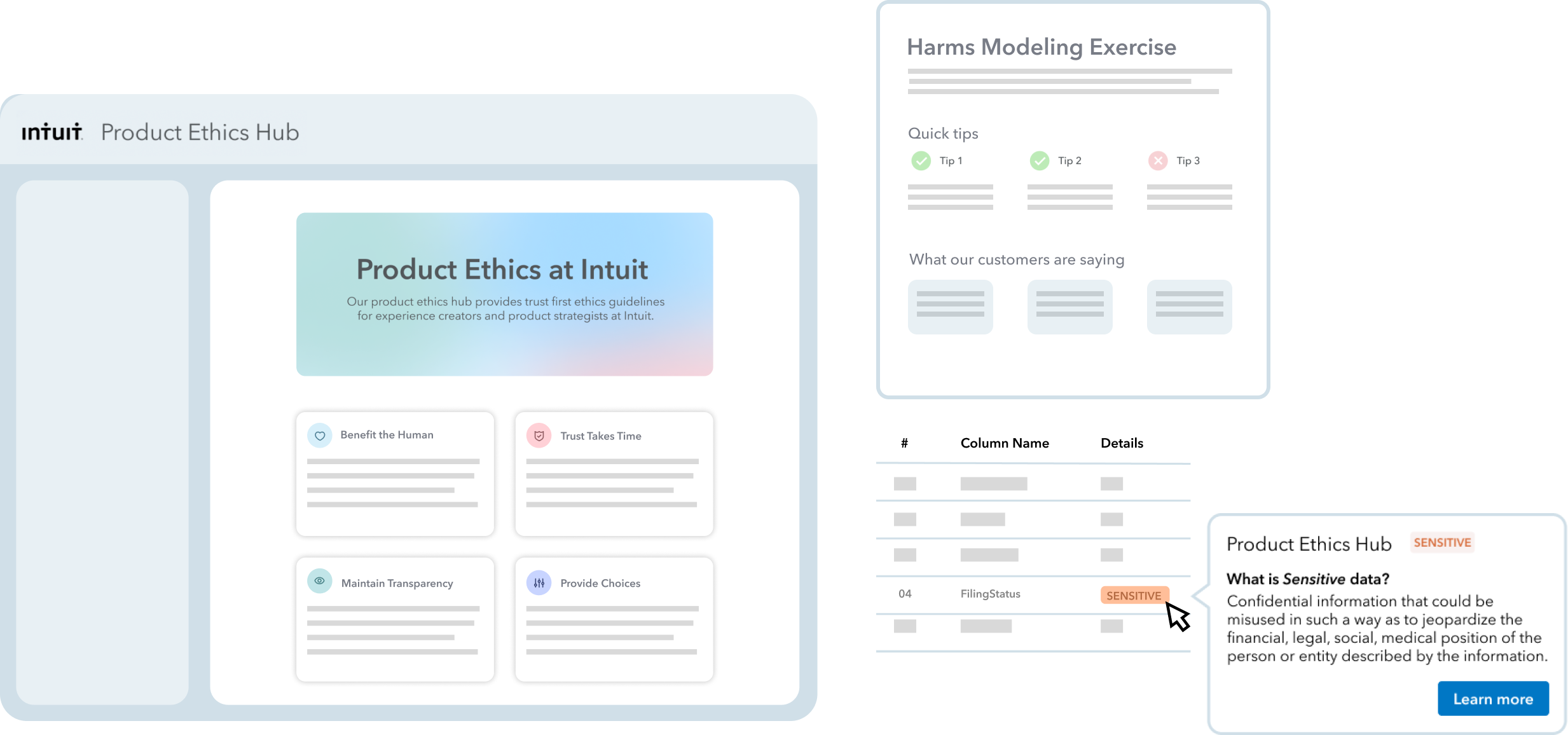

The Intuit Product Ethics Hub provides ethical guidance for Intuit experience creators working on data driven products. It serves as a centralized ethics information source, putting customer research, concrete examples of ethics in action, and empathy exercises at the forefront of product / strategy development workflows.

What does “ethics” mean?

Getting the front and backstage picture

-

Intuit has spent years researching customer sentiment around financial planning, multi-product workflows, and data driven features. Customers expect Intuit products to match their mental models around how they manage their finances. They also want Intuit products to talk to each other, and intelligently predict tasks or life events. Basically, they want to be proactive, rather than reactive about their finances

-

I spoke with PMs, Ethics, Researchers, and Designers to survey existing ethical considerations and processes during product development. Here’s what I found:

❓ Ethics is a nebulous term… want specific use cases, scenarios, guidelines

💬 No consistent ways to communicate data use back to customers

🤦🏽 Ethical standards are confusing + fragmented by product team

☎️ Existing Ask Ethics hotline is underutilized due to lack of awareness

Frontstage: what customers think

Customer Research: Motivation

Previous internal research has shown that customers want a more proactive and predictive financial data experience. Increased data flow and cross-product data sharing will enable that. Is there something about these underlying processes that “creeps customers out”? What is the boundary between unethical and proactive data use from the customer’s perspective?

Customer Insights

Why do you want my data?

Customers are unclear why their data is being collected, and how it can be used to directly benefit them. They still do value financial insights that are explainable.

The human side

Customers have boundaries around emotional/sensitive data points. They expect data to benefit themselves, not a corporation.

Desensitized + fatigued

Customers are desensitized to info collection. Using digital services seemingly leaves no choice but to give up data, due to lack of understanding.

Unknown entities

Customers don’t know where their info travels online. They’re worried about third parties accessing or purchasing their data.

Next, I tried my hand at implementing these customer perspectives in a future state Intuit data experience…

Crafting the ideal experience

Building trust by following customer mental models

My goal

Imagine a future ideal data experience that delivers proactive financial insights, balancing research-backed user mental models around data ethics, with existing Intuit leadership goals for the platform.

Intuit’s Vision: trust-first data moments

Intuit leaders imagined that every customer data moment be designed with a “trust-first” mindset. We could establish trusting relationships with our customers by:

Gathering intent

Providing transparency

Demonstrating value for their unique needs

Offering control and agency

Customers expected Intuit’s platform to learn and grow with them, while not being “creepy” about their data. They wanted Intuit to take it slow and prove value before asking for more info. As customers grew more confident in Intuit’s services, they’d expect tailored, predictive insights.

Leaders described this relationship building process with a Confidence Framework:

You just met me (exploratory, respectful)

“I’m coming to Intuit to help me during an important financial moment... don’t be creepy”

You’re getting to know me (validation, transparency)

“Provide me with transparency around how you have and use my data, and the control to let you know what you can use”

You really know me (personalized, confident)

“I trust you to help me make important finanical decisions and value your advice”

My take on Intuit’s Vision

What if the way Intuit stored and used its data was completely reimagined to match the ways customers think about their data?

Step 1: Store data using customer’s mental model

I wanted Intuit’s data model to grow with how a user thinks about their finances and life… so I designed an information architecture that was aligned with a user mental model rather than a product siloed approach.

Step 2: Predicting financial goals / events

Next, I referred to an existing idea of Intent ML. It uses customer data to predict Intent (i.e. financial goals, and life events which can be tied to goals), instead of the user constantly having to tell us what they want to do.

Step 3: Growing the dataset

I showed how different types of data could be stored and collected into the Finances, Profile, and Life Info buckets. Intent ML could also contribute predicted datapoints to those buckets.

As the buckets grew, IntentML could deliver more powerful insights with higher confidence, building long term financial well-being.

Step 4: Open communication

As we collected more info and delivered increasingly predictive insights, we developed ways to communicate those moments to the customer to build trust.

Key Takeaways

Need ethical checkpoints

It was easy to get carried away with the data possibilities. We found ourselves having to step back and ask if a data use case was indeed ethical

How should we communicate?

At every data collection moment, we had to pause and think… why would a customer want us to do this? How would we explain data use concisely to the customer, enabling them to trust us?

An ethical experience is one that is trustworthy. We need concrete ways to build trust-first data experiences.

Ethics experience principles

Enabling Intuit creators to craft trust-first experiences

Applying what I learned

Customer Interviews

People mistrust Big Tech... they’re disillusioned from constant data misuse, tracking, and confusing messaging.

Internal Interviews

Experience creators strive to create trustworthy experiences, yet they don’t understand what the customer considers ethical.

Ideation Exercise

The data possibilities are endless! What’s the right balance between “smart” and “creepy”? How do we communicate with our user?

The Principles

HMW integrate these ethical standards into the product / strategy workflows of experience creators, Intuit-wide?

Intuit Product Ethics Hub

Enabling Intuit creators to craft trust-first experiences

What is it?

The Intuit Product Ethics Hub provides ethical guidance for Intuit experience creators working on data driven products. It serves as a centralized ethics information source, putting customer research, concrete examples of ethics in action, and empathy exercises at the forefront of product / strategy development workflows.

What I learned

Designing for internal stakeholders → customer impact

Service Design Methods

This internship was a huge opportunity for my career and mindset! I was able to implement all the methodologies I learned in grad school, engaging in systems thinking to gauge the steps that needed to happen backstage to make the customers happy frontstage.

Doing something I feel good about

Coming from a role in healthcare informatics and working on projects for the public good, I’m extremely driven to pursue projects that feel meaningful and beneficial for humanity. Working on this ethics project, my eyes have been opened. I can do something I love, while helping my fellow humans!

Biggest Takeaway: talk to people!

I’m so grateful for the wonderful people I connected with at Intuit. I learned to get comfortable asking tough questions, and referring to the experts when I encountered blindspots. I also saw the importance of talking to real customers… it’s amazing how disparate assumed ideas of customer goals are with what they actually say. I had so much fun speaking with them, and learned a lot.